Tax Updates For 2025 Philippines

Tax Updates For 2025 Philippines - In today's dynamic business landscape, tax regulatory changes. Tax Updates For 2025 Philippines. Paving the way for one bir. On 5 january 2025, the ease of paying taxes (eopt) act was signed into law by president ferdinand marcos, jr.

In today's dynamic business landscape, tax regulatory changes.

On 13 june 2025, the bir released revenue regulations (rr) no.

Stay informed about tax regulations and calculations in philippines in 2025. The april 2025 issue covers the following tax issues:

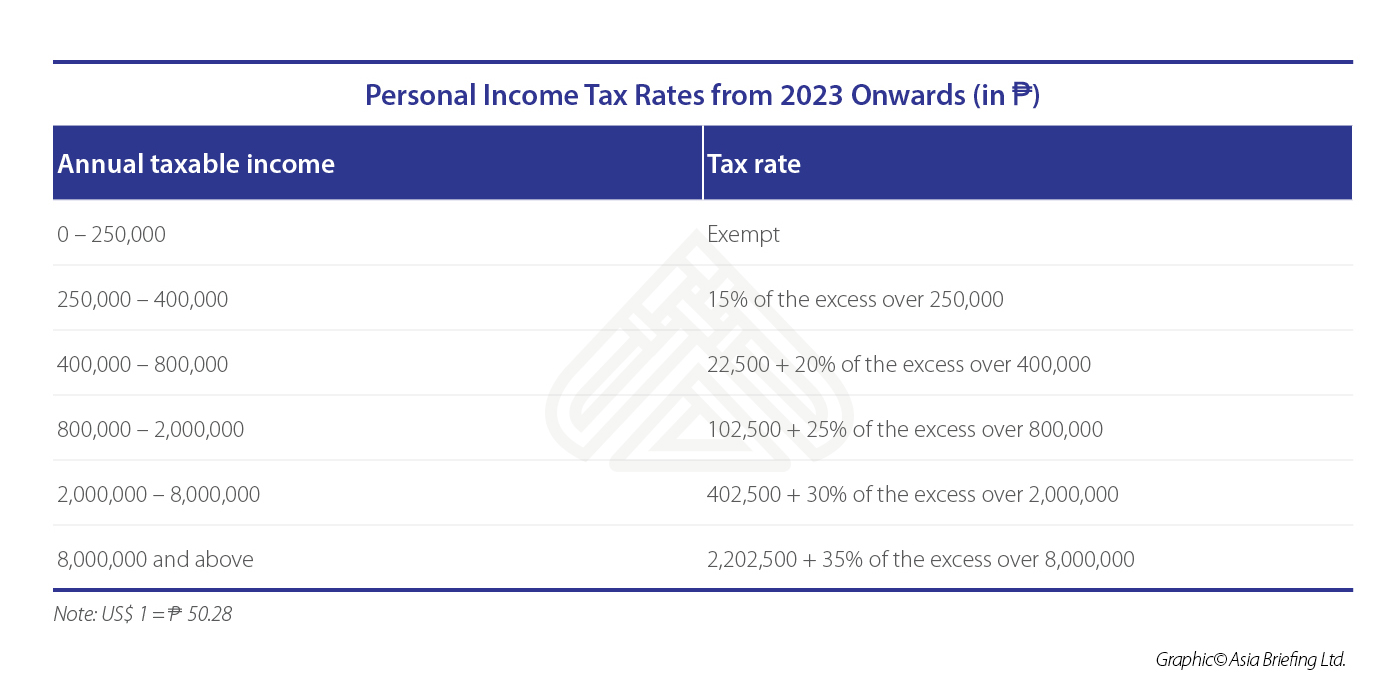

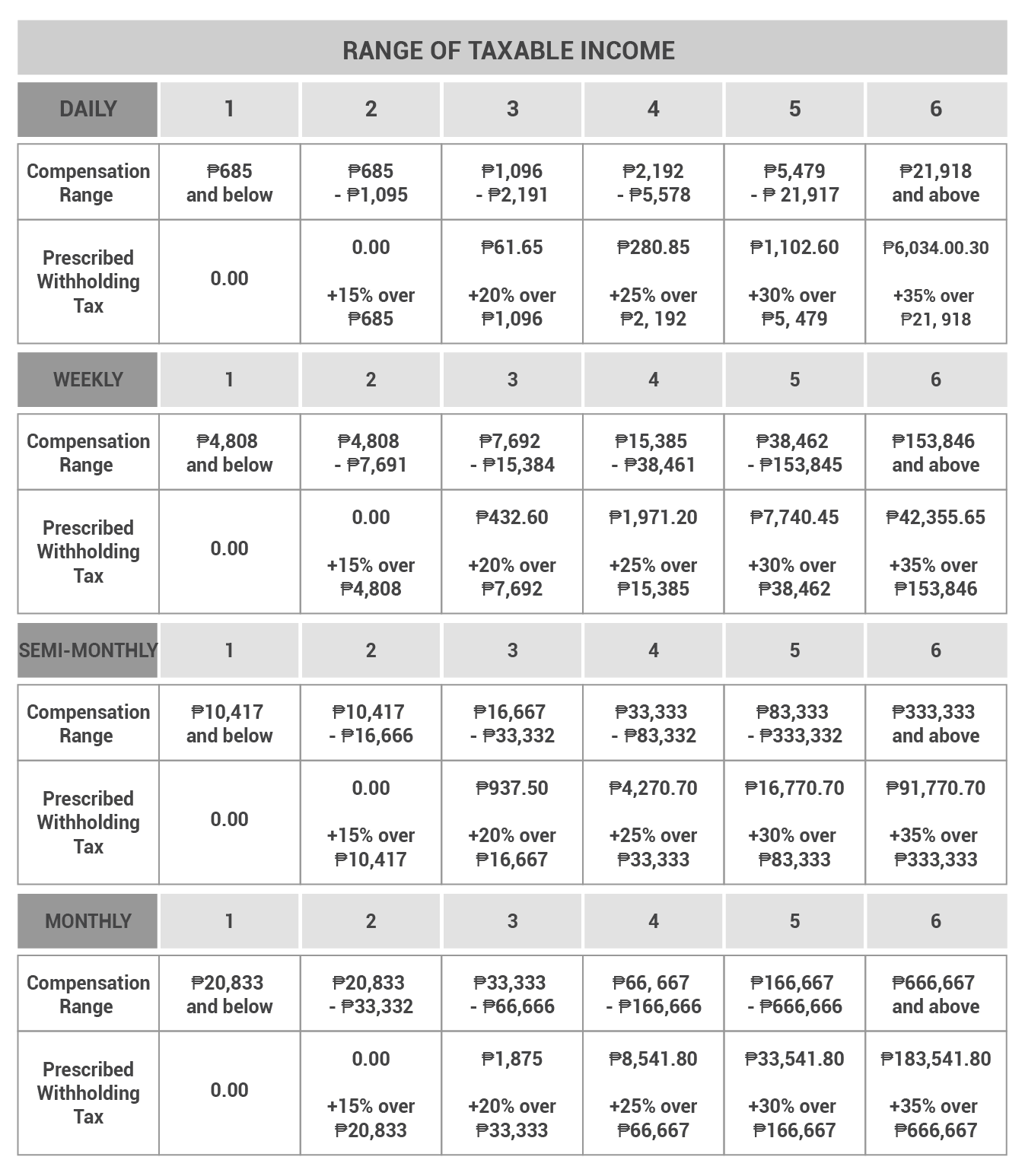

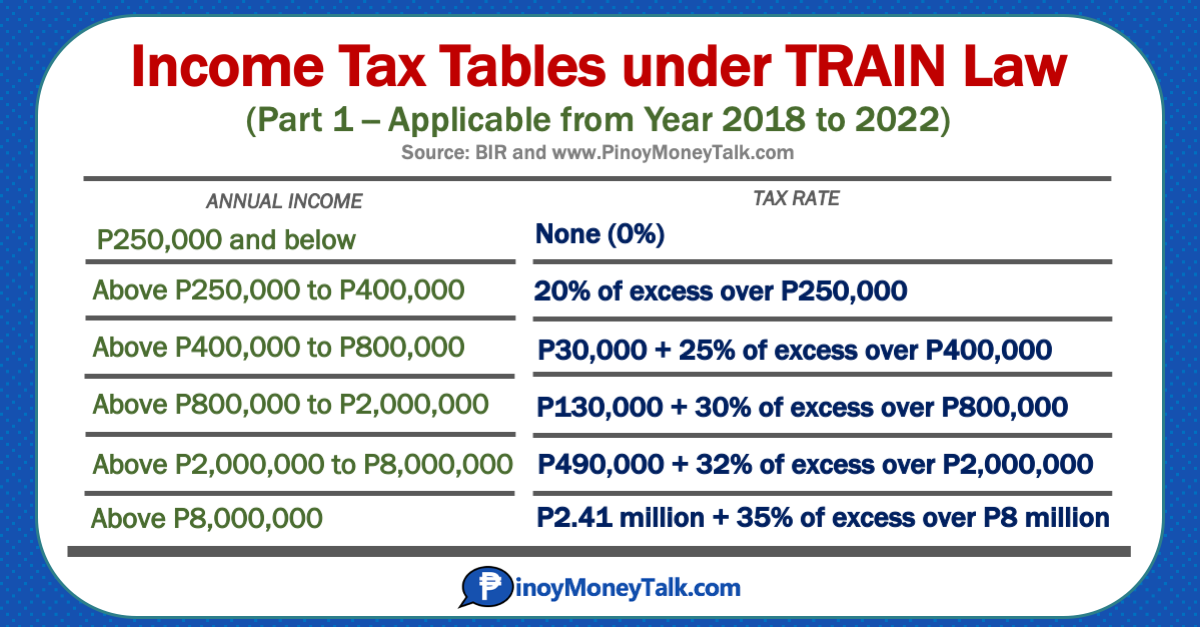

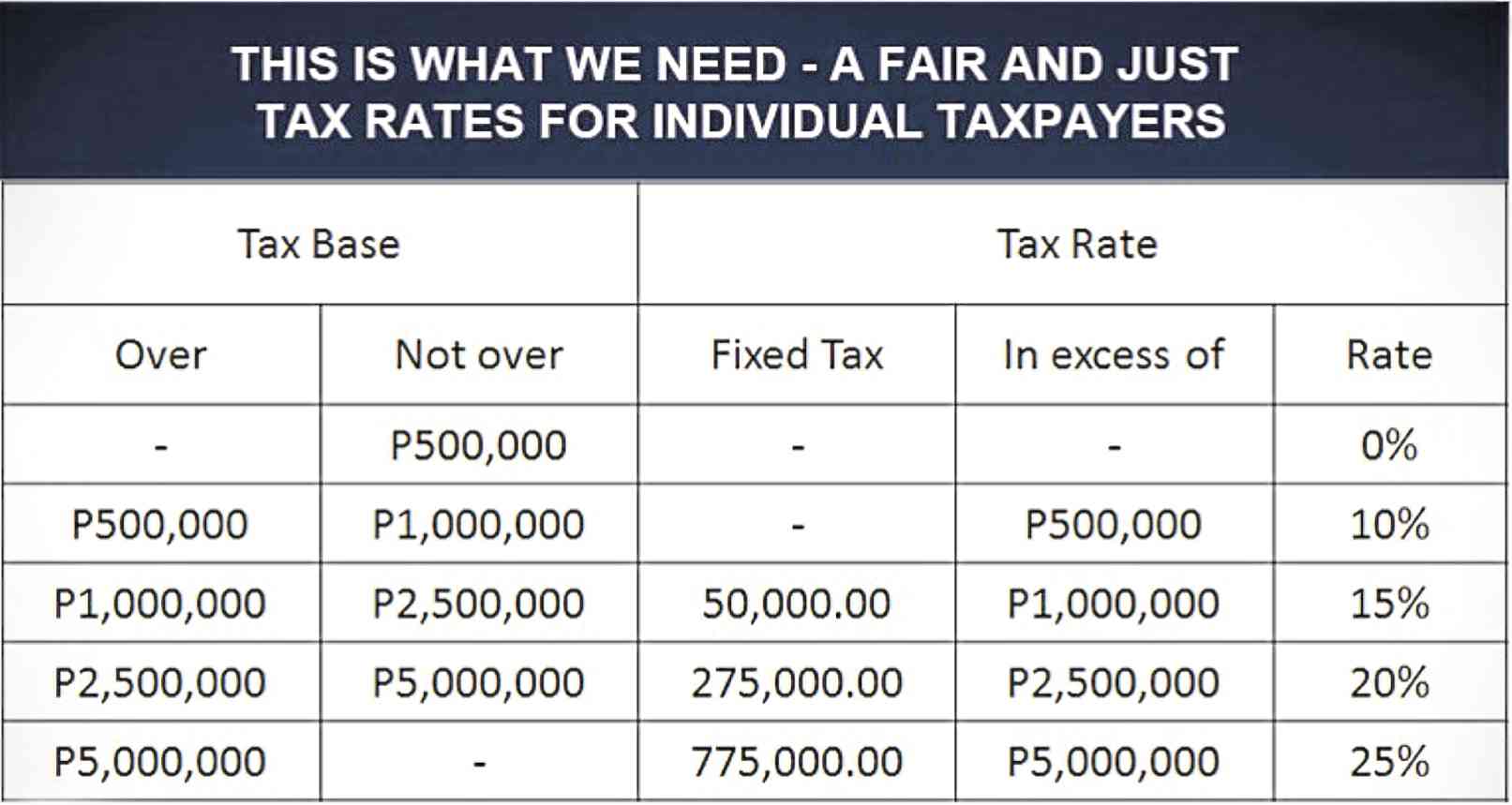

2025 Tax Table Philippines Latest News Update, Discover the latest updates on the 2025 salary increases in the philippines for public servants and private sector employees. Please be informed that the secretary of finance has issued rr no.

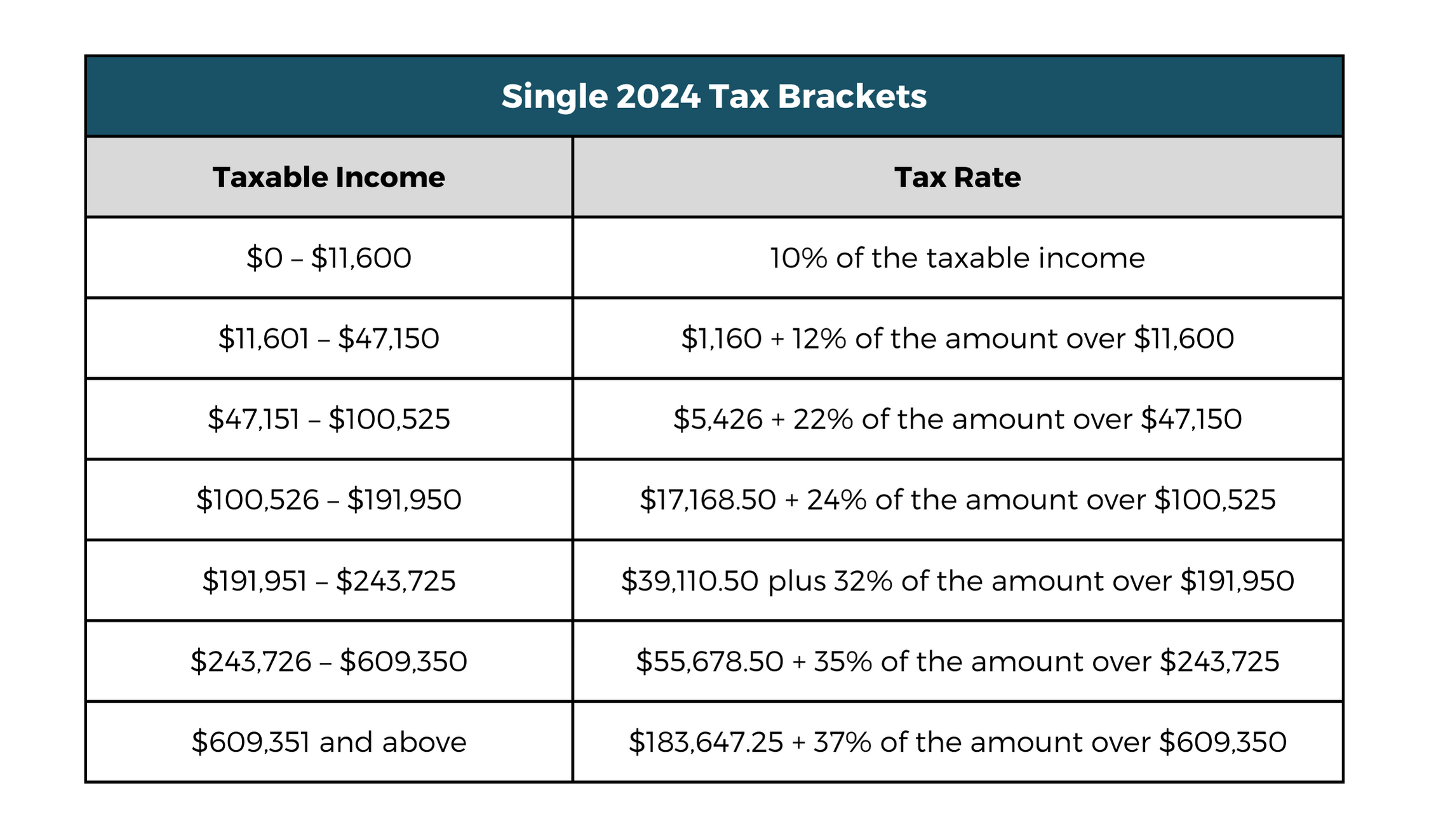

2025 Tax Code Changes Everything You Need To Know, Taxes shall be paid either electronically or manually at the time the return is filed. As we welcome 2025, we have a new law, the ease of paying taxes (eopt) act or republic act no.

Classification of taxpayers into micro, small, medium, and large taxpayers.

Tax rates for the 2025 year of assessment Just One Lap, 11976 and why is it relevant to tax? Understanding these changes is crucial for both employers and employees.

Latest Philippines Tax Reform News Today tax, tax, Per the bir advisory released on. Effective april 27, 2025, any manual/loose leaf “official receipts” issued without a stamped “invoice” will be considered supplementary documents as provided in section 8(2.1) of.

Individual Tax Rates 2025 Philippines Image to u, Internal consultation on eopt draft revenue regulations held. The april 2025 issue covers the following tax issues:

Tax, SSS, and PHIC Updates for 2023 InCorp Philippines, Please be informed that the secretary of finance has issued rr no. In today's dynamic business landscape, tax regulatory changes.

Updates to Form 1040 and 2023 Taxes 2025 Filing Money Instructor, 11976 and why is it relevant to tax? Internal consultation on eopt draft revenue regulations held.